Pfizer A Leader in the Pharmaceutical Industry

BlogPfizer has consistently delivered strong financial performance in recent years. In 2025, the company reported revenue of $48.8 billion and net income of $11.5 billion. Its diversified portfolio of products has allowed Pfizer to capitalize on trends in healthcare and medicine, including the growing demand for vaccines and treatments for chronic diseases.

Pfizer's strong performance can be attributed to its ability to adapt to changes in the healthcare landscape. The company has made significant investments in research and development, allowing it to stay ahead of the curve in terms of new treatments and therapies.

Pfizer's strong cash flow position also provides it with the flexibility to make strategic acquisitions and investments in emerging areas of healthcare, such as gene therapy and immunotherapy. Additionally, the company's strong pipeline of new products has potential to drive long-term growth and profitability.

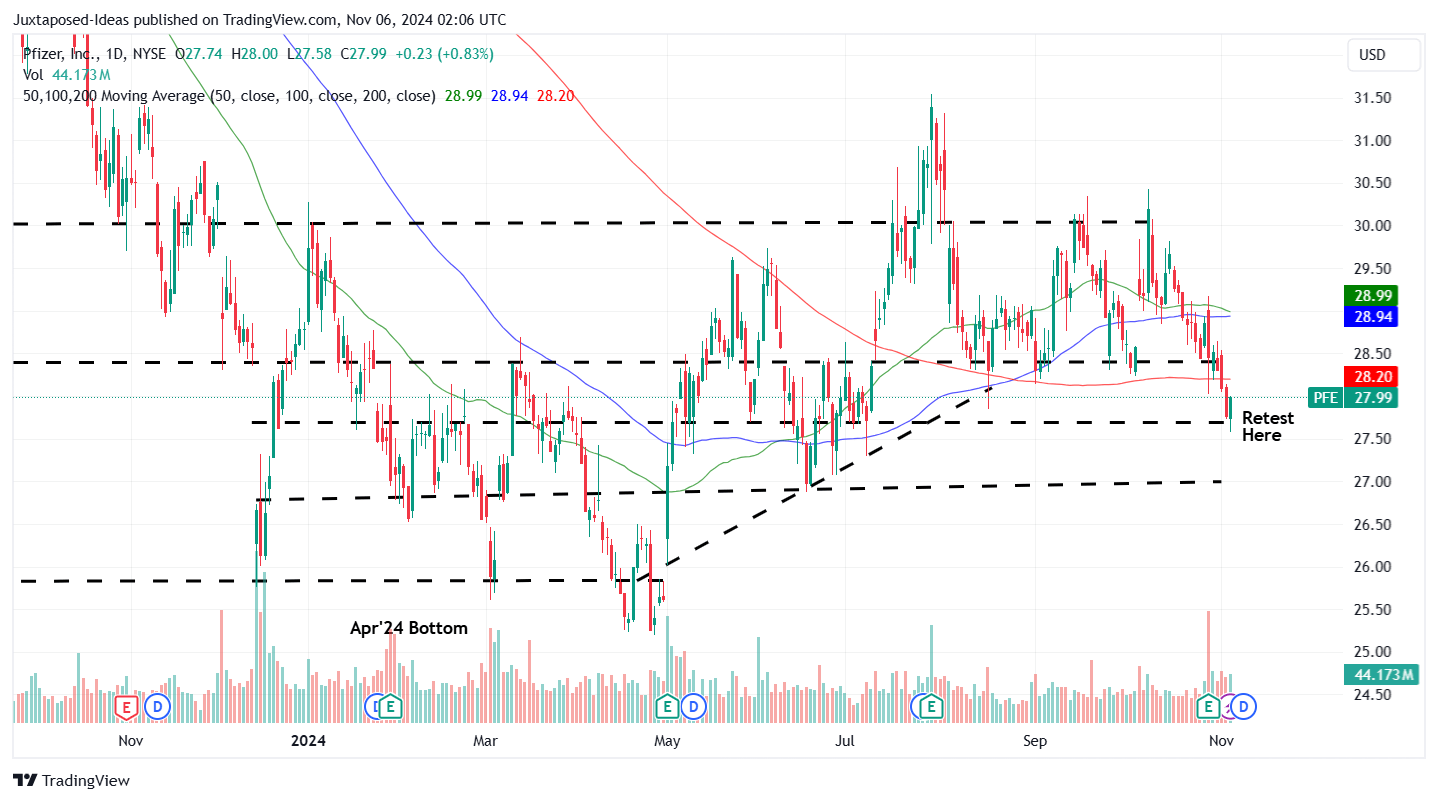

As an investor, Pfizer's current stock price may present a compelling opportunity to get into the company at a relatively low valuation. With its strong track record of performance and potential for long-term growth, PFE is definitely worth considering as part of your investment portfolio.